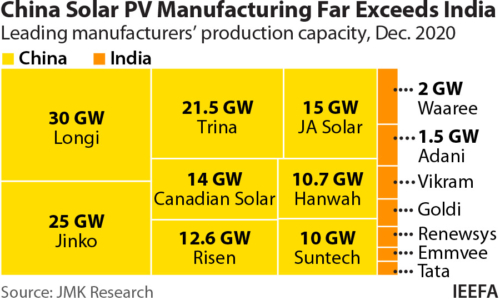

Although one of the top 10 solar module producers in the world, India is lagging behind its biggest competitor China, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research.

The report, Viability Assessment of New Domestic Solar Module Manufacturing Units, finds current production capacity in India is only able to meet 35% of total annual domestic demand.

Co-written by IEEFA’s Vibhuti Garg and JMK’s Jyoti Gulia and co, the report seeks to explain why India is lagging, and what can be done to increase India’s energy security while accelerating its ambitious target to reach 450 gigawatts of renewables by 2030.

“We found capacity utilisation rates of solar module domestic production facilities in India running at only 40-45% and estimated operational capacity of only about 7 gigawatts, despite having an installed domestic PV module manufacturing capacity of about 15 gigawatts,” says Garg.

“Clearly India has the capacity to do much better.”

China is out-performing India in a number of areas, in both manufacturing and research and development.

“China utilizes between 1-3% of gross revenue for solar module R&D every year. In contrast, India’s leading players provide little R&D investment” ” said Gulia. “

The report found that in terms of profit margins, Chinese module suppliers are able to absorb larger shares of profit (on average 4.3%) from operational revenues compared to Indian suppliers who earn an average profit income of less than 3%.

“This is because Chinese module manufacturers have larger-scale production facilities and a low dependence on imports.

“China also has completely integrated facilities producing modules, cells and wafers complemented by robust R&D and favourable government support,” ” said Gulia.

In terms of technology adoption trends, China’s more advanced mono-Si PV modules were reaching two-thirds of the share of the entire global PV production chain in 2019 by gigawatt volume.

“When we compared that to the top 7 Indian domestic module manufacturers in 2019, mono-Si PV modules constituted only 13% of PV production, while 87% comprised of multi-crystalline (or multi-Si) PV modules.

Keeping abreast of technological innovations in the current energy transition towards renewables must be the highest priority,” ” noted Gulia.

The report notes many Indian solar module manufacturers have announced plans to expand existing facilities.

“There are also a lot of players keen on setting up completely new integrated facilities.

While ambition is commendable, these players will face stiff competition from leading global players. Chinese firms’ aggressive capacity expansion coupled with consistent and ongoing technological advancements are yielding PV cells and modules of superior efficiency while still being cost-effective,” said Garg.

Gulia noted the government has a role to play in defining the passage of solar manufacturing going forward.

“Central government needs to provide a balanced manufacturing framework nestled in a long term strategy to assist domestic players to compete in the global field.

While only a short term solution to boost the local market, the imposition of safeguard and basic custom duties designed to increase the price of imported modules will assist domestic manufacturers,” She went on to say.

“Any planned initiatives should not be limited to this, however. The focus should also be on helping manufacturers become globally competitive.”

Meanwhile, Garg pointed out that energy security is a key concern for India and investing locally in the solar module sector is one of the pathways towards achieving that.

“A self-reliant solar sector would not only cater to domestic demand but would also open new avenues of exports, especially after the COVID-19 supply chain shock that has forced numerous countries to look elsewhere for alternatives to China’s goods.

India could meet those global solar PV needs, with the right government support behind the sector,” he said.

More Stories