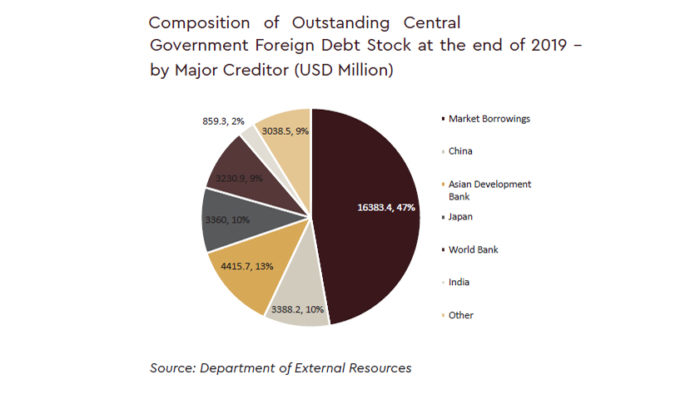

China, which began financing Sri Lanka a little over a decade ago has overtaken traditional lenders Japan and the World Bank and is just behind the Asian Development Bank, official data show.

Mainly project loans to Sri Lanka from China were 3.38 billion US dollars by end 2019, against 3.36 billion US dollars for Japan and 3.23 billion US dollar for the World Bank, finance ministry data showed.

China Development Bank Corporation has also loaned Sri Lanka a billion US dollars, in response to a call for market borrowings in 2018, but it was below market rates at the time of 2.56 percent for eight years, mostly as a bailout, analysts say.

China is also giving a budget support loan in 2020 which will also help with debt repayment this year.

In 2019 China disbursed most loans to Sri Lanka, with 648 million US dollars, ahead of Asian Development Bank with 279.5 million US dollars, Japan 187.5 million US dollars and World Bank 177.7 million dollars.

For several years China has topped the annual list of new lenders.

China also committed the most new loans in 2019 with 1,061 million US dollars, followed by ADB with 765 million US dollars, World Bank at 421 million US dollars and ADB 282.2 million US dollars.

China had a total of 2.0 billion US dollars in committed and undisbursed loans, compared to 2.1 billion US dollars by ADB, 1.8 billion US dollars by Japan and 1.28 billion by the World Bank.

In terms of outstanding loans China is now behind Japan which had loaned 4.41 billion US dollars by end 2019.

Japan became a key lender to Sri Lanka after 1978 when then-President J R Jayewardene became President.

The ADB is also an agency where Japan has influence and became a co-financier

China’s Asia Infrastructure Investment Bank is also now emerging as a key creditor to Sri Lanka.

China has also loaned directly to some state owned enterprises which is not counted in the central government loan stock.

Related

China backed AIIB emerges as a key lender to Sri Lanka in 2019

China has drawn criticism for financing projects considered useful under its Belt and Road project, which has put some borrowing countries in difficulties.

Japan, the ADB and World Bank have funded Sri Lanka after feasibility studies while China tends to finance projects fast, critics have said.

Japan and the ADB had been giving loans to develop Colombo Port for decades and the Sri Lanka Ports Authority became a highly profitable agency.

However SLPA was unable to generate cash to repay a loan take to finance the Hambantota Port and the last administration sold a key stake to a Chinese firm for cash and loan was taken of SLPA books.

Sri Lanka’s auditor general has qualified finance ministry accounts saying the port loan is neither in the books of the SLPA nor listed as a liability of the central government.

Projects that do not bring revenues force the government to seek foreign market borrowings to repay installments.

Sri Lanka’s foreign borrowings rose to 32.6 billion US dollars in 2019 up from 28.7 billion US dollars in 2018.

Analysts have also warned that liquidity injections by the central bank which generate foreign exchange shortages also makes the dollar debt stock to go up by forcing market borrowings.

Liquidity injections make it impossible to turn current account dollar inflows into financial account outflows

More Stories

Sri Lanka’s exports to China up 33% from January to February

China becomes the fifth largest market for Ceylon tea

Chinese Social Media Reacts to Mayor Buttigieg’s Ambassador Reports